Finding the best accounting software for your small business in 2025 can feel overwhelming. You want a tool that’s simple to use, reliable, and helps you save time and money.

Imagine having all your invoices, expenses, and reports in one place—effortlessly organized. That’s exactly what the Best Accounting Software for Small Business can do for you. You’ll discover the top options designed specifically for small businesses like yours, so you can focus more on growing and less on crunching numbers. One standout solution you shouldn’t miss is Freshbooks. Keep reading to learn why it might be the perfect fit for your business needs.

Credit: businessezee.com

Introduction To Accounting Software For Small Businesses

Managing finances is one of the most challenging tasks for small businesses. Without proper tools, tracking expenses, invoicing clients, and ensuring tax compliance can become overwhelming. This is where accounting software comes into play. These tools simplify complex financial processes, saving time and reducing errors. In 2025, small businesses have more choices than ever to streamline their financial management.

Why Small Businesses Need Specialized Accounting Tools

Small businesses operate differently compared to large corporations. They often have limited budgets and fewer staff members. Specialized accounting software addresses these needs by offering features tailored for small-scale operations. Below are some of the reasons small businesses need these tools:

- Cost Efficiency: Most small-business accounting software is affordable and offers subscription-based pricing.

- User-Friendly Interface: Designed for owners with no accounting background.

- Scalability: These tools grow with your business, allowing you to add features as needed.

- Compliance: Keeps your business aligned with tax regulations and reporting requirements.

- Time-Saving: Automates repetitive tasks like invoicing and expense tracking.

How Accounting Software Streamlines Financial Management

Accounting software simplifies day-to-day financial operations. It ensures small businesses can focus on growth instead of manual bookkeeping. Here are some ways these tools streamline financial management:

| Feature | Benefit |

|---|---|

| Automated Invoicing | Generates and sends invoices quickly, reducing delays in payments. |

| Expense Tracking | Records all expenses, helping you monitor cash flow effectively. |

| Tax Preparation | Organizes your financial data to simplify tax filing. |

| Reporting and Analytics | Provides insights into financial performance for better decision-making. |

| Cloud Integration | Lets you access financial data anytime, anywhere. |

One standout option for small businesses in 2025 is FreshBooks. It offers features like automated billing, time tracking, and expense management, making it a popular choice among entrepreneurs.

Top Accounting Software Solutions For Small Businesses In 2025

Choosing the right accounting software helps small businesses manage finances efficiently. The best tools in 2025 combine ease of use, powerful features, and affordable pricing. These solutions support invoicing, expense tracking, tax preparation, and financial reporting. They save time and reduce errors. Here is an overview of top options and the criteria used to select them.

Overview Of Leading Products And Their Unique Selling Points

Add more products here if needed

| Software | Key Features | Unique Selling Points | Best For |

|---|---|---|---|

| FreshBooks |

|

| Freelancers and service businesses |

Key Factors Considered In Our Selection Process

- Ease of Use: Simple navigation and clear design for beginners.

- Features: Core accounting functions like invoicing, tracking, and reporting.

- Pricing: Affordable plans with good value for money.

- Customer Support: Responsive help via chat, phone, or email.

- Integration: Ability to connect with bank accounts and other software.

- Security: Data protection with encryption and backups.

- Scalability: Software that grows with the business needs.

Key Features That Set These Accounting Tools Apart

Choosing the right accounting software means finding one that simplifies financial tasks. The best tools provide features that save time and reduce errors. They help manage money clearly and keep businesses on track. These features work together to make accounting easier and more accurate.

Automated Bookkeeping And Expense Tracking Benefits

Automation reduces manual work and mistakes. Software like FreshBooks automatically records transactions and tracks expenses. It links bank accounts and credit cards to update records instantly. This saves hours and ensures every cost is accounted for.

- Auto-categorizes expenses for easy review

- Tracks receipts by uploading photos

- Alerts for unusual spending patterns

- Syncs data across multiple accounts

Invoicing And Payment Integration To Improve Cash Flow

Fast invoicing speeds up payments. FreshBooks offers customizable invoices that send automatically. It integrates with payment gateways like PayPal and Stripe. This helps businesses get paid faster and keeps cash flow steady.

- Send invoices via email with reminders

- Accept credit cards and online payments

- Track invoice status in real-time

- Set recurring invoices for ongoing work

Tax Preparation And Compliance Simplified

Tax season is less stressful with built-in tools. FreshBooks calculates taxes based on your region. It organizes expenses and income for easy tax filing. The software helps stay compliant with local tax laws and deadlines.

- Automatic tax calculations and reports

- Export tax data for accountants

- Track sales tax collected and owed

- Set tax rates for different products

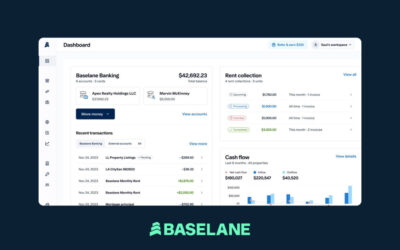

Real-time Financial Reporting For Informed Decision-making

Reports show business health at a glance. FreshBooks offers dashboards with up-to-date financial data. Owners see profit, loss, and cash flow instantly. This helps make smart, quick decisions.

| Report Type | Benefits |

|---|---|

| Profit & Loss | Shows income and expenses over time |

| Balance Sheet | Displays assets, liabilities, and equity |

| Cash Flow | Tracks money coming in and out |

User-friendly Interface And Accessibility Across Devices

Simple design helps users of all skill levels. FreshBooks works on desktops, tablets, and phones. This allows business owners to manage accounts anytime, anywhere. The clear layout reduces errors and speeds up tasks.

- Easy navigation with clear menus

- Mobile app with full feature set

- Cloud-based access for data security

- Multi-user support with permission controls

Pricing And Affordability Analysis

Small businesses often prioritize affordability when selecting accounting software. Understanding the cost structure helps determine the best fit for your budget. This section explores subscription plans, one-time purchase options, ROI, and free trials to help you make an informed decision.

Comparing Subscription Plans And One-time Purchase Options

Accounting software pricing models vary significantly. FreshBooks offers subscription-based pricing, ideal for businesses seeking flexibility. Plans start at $17/month, scaling up based on features. Subscription models often include regular updates and customer support.

Some software provides one-time purchase options, allowing lifetime access. This model suits businesses preferring upfront payments to avoid recurring fees. While one-time purchases save money long-term, they may lack regular updates included in subscriptions.

| Pricing Model | Pros | Cons |

|---|---|---|

| Subscription Plans |

|

|

| One-Time Purchase |

|

|

Cost Versus Value: Which Software Offers The Best Roi?

Evaluating ROI involves balancing price with features. FreshBooks provides robust functionality like invoicing, expense tracking, and time management. These features streamline operations, saving time and money.

Priced at $17/month for basic plans, FreshBooks delivers exceptional value. Businesses gain tools to improve efficiency and reduce manual work. Higher-tier plans include advanced features like project management, which enhance productivity further.

To maximize ROI, consider your business needs. Opt for plans offering essential features without overspending on extras.

Free Trials And Money-back Guarantees: What To Expect

Many accounting software providers, including FreshBooks, offer free trials. These trials let users explore features risk-free. FreshBooks provides a 30-day free trial, enabling businesses to test compatibility with their needs.

Additionally, money-back guarantees ensure peace of mind. FreshBooks offers a guarantee policy, allowing cancellations without penalties within the trial period. This flexibility helps businesses avoid committing to unsuitable software.

Always review trial terms and guarantee policies before signing up. Understanding limitations ensures a smooth testing experience.

Pros And Cons Based On Real-world Usage

Choosing the right accounting software for small businesses depends on understanding both its advantages and drawbacks from actual users. This section highlights key strengths, common limitations, and support options based on real-world feedback. Clear insights help small business owners make informed decisions that fit their needs.

Strengths That Enhance Small Business Accounting Efficiency

- User-Friendly Interface: FreshBooks offers a simple, clean design that helps users manage invoices and expenses easily.

- Automated Invoicing: Automatic invoice reminders and recurring billing save time and improve cash flow management.

- Expense Tracking: Real-time expense entry with photo receipt uploads reduces manual work and errors.

- Time Tracking: Integrated timer helps freelancers and service providers bill hours accurately.

- Cloud-Based Access: Access accounting data anytime, anywhere on multiple devices.

- Financial Reporting: Generates clear reports that help track profits and expenses effectively.

Common Limitations And Potential Drawbacks

| Limitation | Impact on Small Businesses |

|---|---|

| Limited Inventory Management | Not ideal for businesses needing detailed stock tracking or product management. |

| Higher Cost for Advanced Features | Premium plans may be expensive for very small businesses or startups. |

| Less Suitable for Large Teams | Limited multi-user collaboration options compared to some competitors. |

| Learning Curve for New Users | Some users report initial setup and feature navigation requires time. |

Customer Support And Community Resources Evaluation

FreshBooks provides multiple support channels to assist users:

- Email and Phone Support: Available during business hours for direct help.

- Live Chat: Quick responses for common questions and troubleshooting.

- Help Center: Extensive online guides, FAQs, and tutorials cover most topics.

- Community Forum: Users share tips and solutions, building a helpful network.

Support quality is generally praised for responsiveness and friendliness. Some users note wait times during peak hours. The self-help resources reduce dependence on direct support for routine issues.

Credit: amnistreasury.com

Ideal User Profiles And Best Use Case Scenarios

Choosing the right accounting software depends on the user’s business size, complexity, and industry. Different solutions fit different needs. Understanding ideal user profiles helps match features to business demands. This section breaks down who benefits most from specific software and why.

Startups And Freelancers: Lightweight Solutions That Scale

Startups and freelancers need simple, easy-to-use software. Freshbooks fits well here. It offers:

- Simple invoicing and expense tracking

- Time tracking for billing clients

- Cloud-based access for remote work

- Automation of recurring invoices

These features help manage finances without complexity. Freshbooks scales as businesses grow, adding more clients and projects smoothly.

Growing Small Businesses Needing Advanced Features

Small businesses expanding operations need more advanced tools. Freshbooks provides:

- Detailed financial reports and analytics

- Integration with payment gateways for faster cash flow

- Team collaboration tools for multiple users

- Project profitability tracking

These features support decision-making and improve efficiency. Businesses can control budgets and track expenses accurately.

Industry-specific Needs And Software Suitability

Some industries require specialized features in accounting software. Freshbooks suits service-based businesses like:

- Consultants

- Designers

- Lawyers

- Freelancers

It handles client management, invoicing, and time tracking well. However, manufacturing or retail businesses might need software with inventory management and point-of-sale features, which Freshbooks lacks.

| Industry | Best Use Case | Freshbooks Suitability |

|---|---|---|

| Consulting | Time tracking and client invoicing | Excellent |

| Creative Services | Project billing and expense management | Excellent |

| Retail | Inventory and sales tracking | Limited |

| Manufacturing | Inventory and cost of goods sold | Limited |

Conclusion And Final Recommendations

Choosing the best accounting software can transform your small business finance management. The right tool saves time, reduces errors, and improves financial clarity. FreshBooks stands out as a reliable option with easy-to-use features tailored for small businesses. It supports invoicing, expense tracking, and reporting, all in one platform.

Success depends on selecting software that fits your business needs and ensuring smooth setup. The sections below offer practical advice to help you make the best choice and get the most from your software.

How To Choose The Right Accounting Software For Your Business

- Assess Your Business Needs: Identify essential features like invoicing, payroll, or tax support.

- Consider User Friendliness: Choose software with a simple interface for easy daily use.

- Check Integration Options: Ensure compatibility with your bank and other business tools.

- Evaluate Pricing Plans: Pick a plan that fits your budget without hidden fees.

- Look for Customer Support: Reliable help is vital for solving issues quickly.

- Read Reviews and Ratings: Learn from other small business experiences.

Tips For Seamless Implementation And Maximizing Benefits

- Plan Your Setup: Prepare all financial data before starting to use the software.

- Train Your Team: Provide simple guides or tutorials to ensure everyone understands the tool.

- Start Small: Use basic features first, then add advanced functions gradually.

- Regularly Update Data: Keep your records current to avoid mistakes.

- Use Reporting Tools: Monitor your business performance through built-in reports.

- Back Up Data: Protect your financial information with regular backups.

Credit: www.pcmag.com

Frequently Asked Questions

What Is The Best Accounting Software For Small Businesses?

The best accounting software offers ease of use, affordability, and essential features. Look for invoicing, expense tracking, and reporting tools. Popular options include QuickBooks, Xero, and FreshBooks. Choose software that fits your business size and needs for optimal results.

How Much Does Accounting Software Cost In 2025?

Accounting software prices vary from free plans to $70+ monthly subscriptions. Costs depend on features, user numbers, and integrations. Many providers offer scalable pricing to suit small business budgets. Always compare plans to find the best value for your business.

Can Small Businesses Use Cloud-based Accounting Software?

Yes, cloud-based accounting software is ideal for small businesses. It provides real-time access, automatic updates, and data security. You can work from anywhere and collaborate easily. Most top providers offer cloud solutions with mobile apps for convenience.

What Features Should Small Business Accounting Software Have?

Essential features include invoicing, expense tracking, bank reconciliation, and financial reporting. Payroll management and tax support are also helpful. Integration with payment gateways and other tools saves time. Choose software that simplifies bookkeeping and improves financial insights.

Conclusion

Choosing the right accounting software simplifies managing your small business finances. Tools like FreshBooks offer user-friendly features for invoicing, expense tracking, and reporting. They help save time and reduce errors. Evaluate your needs and budget before deciding. Start exploring FreshBooks with this exclusive link. A streamlined accounting process can boost productivity and keep your business on track. Make the switch to efficient financial management today.